NY C-105.32 2004-2024 free printable template

Show details

State of New York

WORKERS' COMPENSATION BOARDS AGENCY EMPLOYS AND SERVES

PEOPLE WITH DISABILITIES WITHOUT

DISCRIMINATION.NOTICE OF ELECTION OF A PARTNERSHIP, LIMITED LIABILITY PARTNERSHIP, PROFESSIONAL

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your ny professional sole form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ny professional sole form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ny professional sole online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit ny notice liability form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to deal with documents.

How to fill out ny professional sole form

To fill out the NY professional sole, you can follow these steps:

01

Visit the official website of the NY Department of State or relevant regulatory body.

02

Look for the section dedicated to professional solitary businesses.

03

Download or access the appropriate application form for filling out the NY professional sole.

04

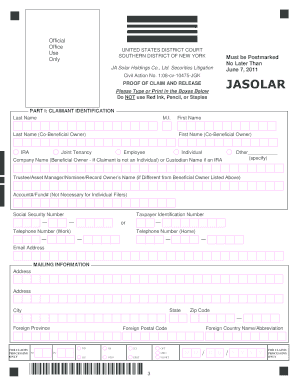

Fill in the required personal information, such as your full name, address, and contact details.

05

Provide the necessary professional information, including your area of expertise, qualifications, and any relevant licenses or certifications.

06

If applicable, disclose any affiliations, memberships, or partnerships related to your profession.

07

Review the form for accuracy and completeness, ensuring that all sections are properly filled out.

08

Sign the form as required, either electronically or physically, depending on the submission method.

09

Submit the completed form along with any supporting documents or fees as specified in the instructions.

10

Keep a copy of the filled-out form and any related documents for your records.

Who needs ny professional sole?

01

Individuals who wish to establish a professional solitary business in the state of New York.

02

Professionals seeking to provide their services independently without being part of a larger firm or organization.

03

Those who have the necessary qualifications, licenses, and certifications in their respective fields and meet the requirements set by the regulatory body.

Fill election partnership proprietorship online : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Who is required to file ny professional sole?

A professional sole proprietor in New York is required to file an income tax return if they meet certain criteria. The specific criteria depend on the individual's income level and filing status. Generally, if their net earnings from self-employment exceed $400 in a year, they are required to file a federal income tax return. Additionally, they may need to file a New York State income tax return if they meet the state's filing requirements. It is recommended to consult with a tax professional or refer to the official tax authorities for accurate and up-to-date information regarding tax filing requirements.

What is the penalty for the late filing of ny professional sole?

In New York, the penalty for late filing of a professional sole proprietorship is a late fee. The late fee depends on the duration of the delay in filing. Generally, the fee is $50 for each month or part of a month that the filing is overdue. However, the late fee cannot exceed $200 for each year the filing is late. It is important to note that these fees are subject to change, so it is recommended to consult the official website of the New York State Department of State or seek professional advice for the most accurate and up-to-date information.

How can I get ny professional sole?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific ny notice liability form and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

Can I create an eSignature for the ny election limited blank in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your ny professional sole form and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

How can I edit ny limited professional proprietorship on a smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing notice proprietorship form right away.

Fill out your ny professional sole form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ny Election Limited Blank is not the form you're looking for?Search for another form here.

Keywords relevant to notice proprietorship form

Related to ny election limited online

If you believe that this page should be taken down, please follow our DMCA take down process

here

.